SBA GRADES

Top 100 banks committed to SBA 7(a) loans

MultiFunding has identified the top 100 financial institutions that are committed to Small Business Administration (SBA) 7(a) loans in fiscal year 2017 based on analysis of reported data.

Data Collection Method

The top 100 financial institutions were determined through data downloaded from the websites of the SBA, the Federal Deposit Insurance Corporation (FDIC), the National Credit Union Administration (NCUA), as well as the financial institutions’ websites that are not regulated by these organizations.

The top banks based on assets have 27,000 combined branches nationwide. Below is their average number of SBA 7(a) loans originated per branch:

Top 10 Banks Nationwide

TD Bank 3 SBA 7(a) loans per branch

Wells Fargo 1 SBA 7(a) loan per branch

U.S. Bank 1 SBA 7(a) loan for every 1.5 branches

JP Morgan Chase 1 SBA 7(a) loan for every 1.5 branches

Citibank 1 SBA 7(a) loan for every 3 branches

SunTrust 1 SBA 7(a) loan for every 3 branches

Capital One 1 SBA 7(a) loan for every 5 branches

PNC Bank 1 SBA 7(a) loan for every 6 branches

BB&T 1 SBA 7(a) loan for every 10 branches

Bank of America 1 SBA 7(a) loan for every 20 branches

In contrast, here are the top three SBA 7(a) lenders in the country with just one branch:

Celtic Bank 1,417 SBA 7(a) loans

Independence Bank 1,141 SBA 7(a) loans

Live Oak Bank 1,055 SBA 7(a) loans

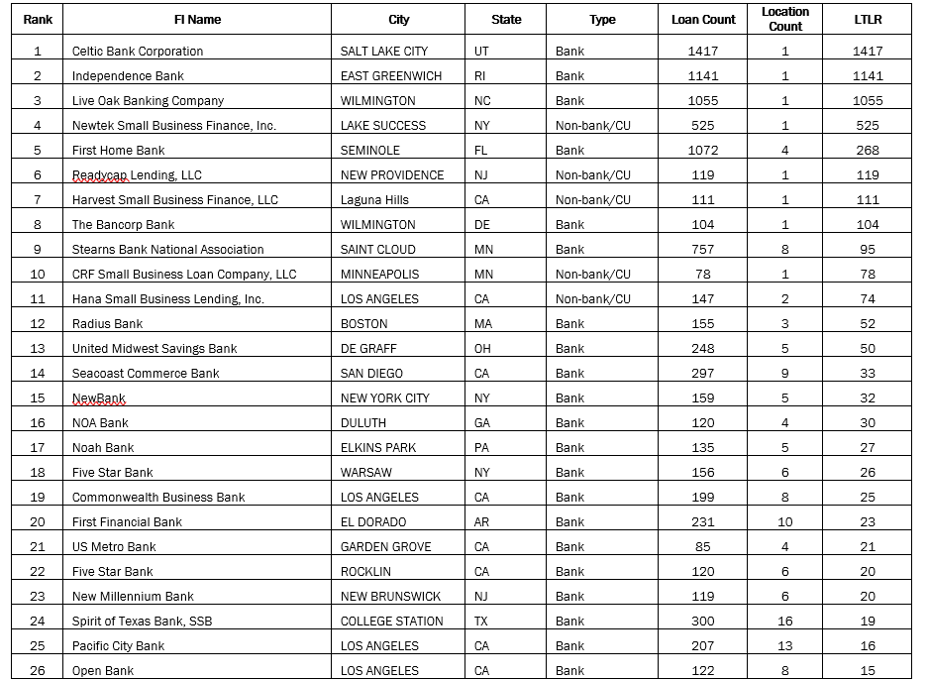

MultiFunding’s rankings were based on each financial institution’s SBA 7(a) loan count and the ratio of the SBA 7(a) loan count to the number of locations. This methodology differs from other SBA lending rankings in that it relates loan count to geographical reach as an indicator of commitment to small business lending, rather than just looking at the absolute number of SBA 7(a) loans originated.

Other highlights of the analysis are as follows:

● Composition. Only a small percentage of banks and credit unions supervised by the FDIC and the NCUA originated SBA 7(a) loans in 2017: 28 percent of all FDIC- supervised banks and 3 percent of all NCUA- supervised credit unions;

● Concentration. The top 100, or just 5 percent out of 1,931 financial institutions, make up 71 percent and 64 percent of SBA 7(a) lending in terms of number of loans and value of loans, respectively; and

● Seven financial institutions in the top 100 are not banks or credit unions.

Some Thoughts About the SBA Program

Ami Kassar & Fran Tarkinton Discuss the Benefits

"The SBA 7(a) is an incredible loan program which helps entrepreneurs get the capital they need to grow their businesses at affordable prices. For most business owners, the search for capital starts by walking into the local bank where they maintain their deposits. Based on MultiFunding’s analysis, the most ubiquitous banks are not necessarily the same banks who can provide business owners information about the SBA 7(a) loan program."

–Ami Kassar

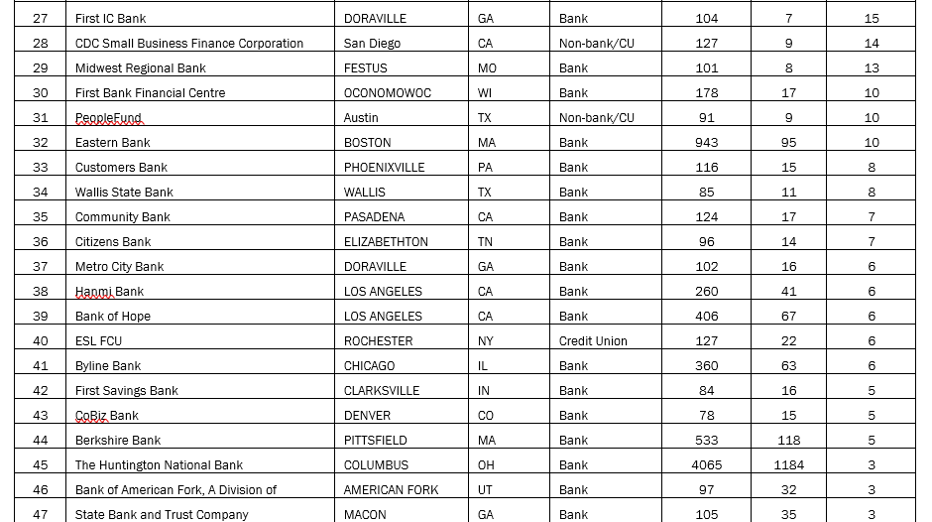

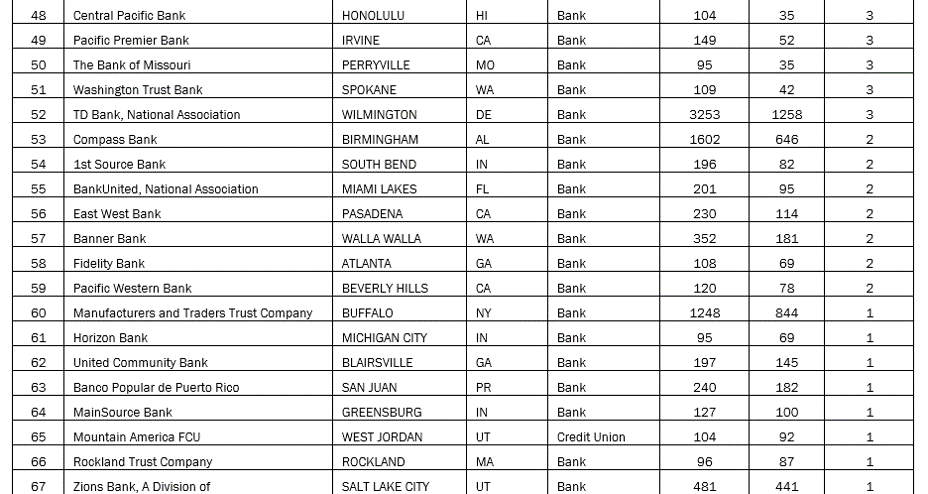

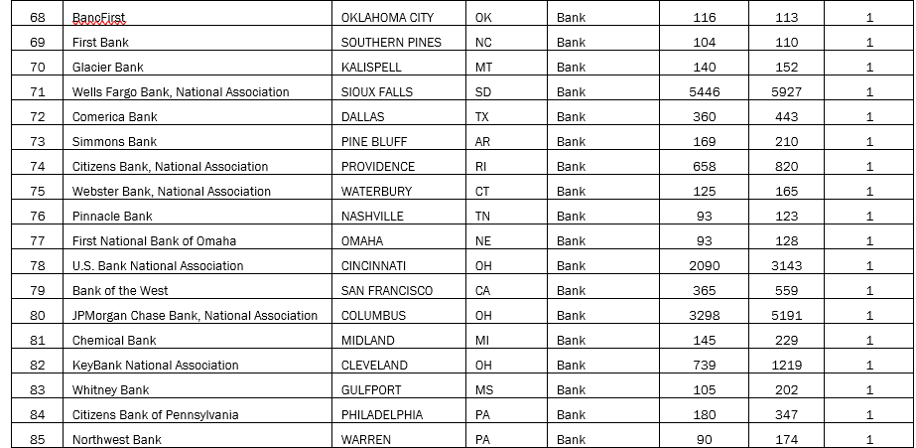

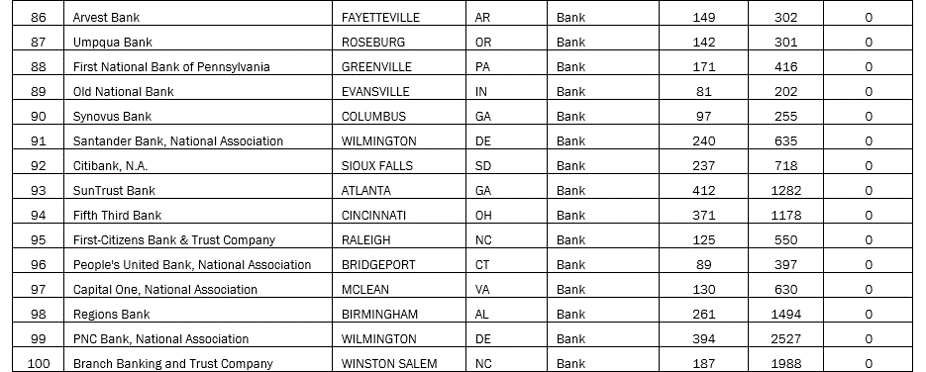

Here Are The Top 100

We are happy to share the full list of SBA 7(a) friendly banks.